1. Application exercise, vertical modules

Module 1. THE BALANCE SHEET

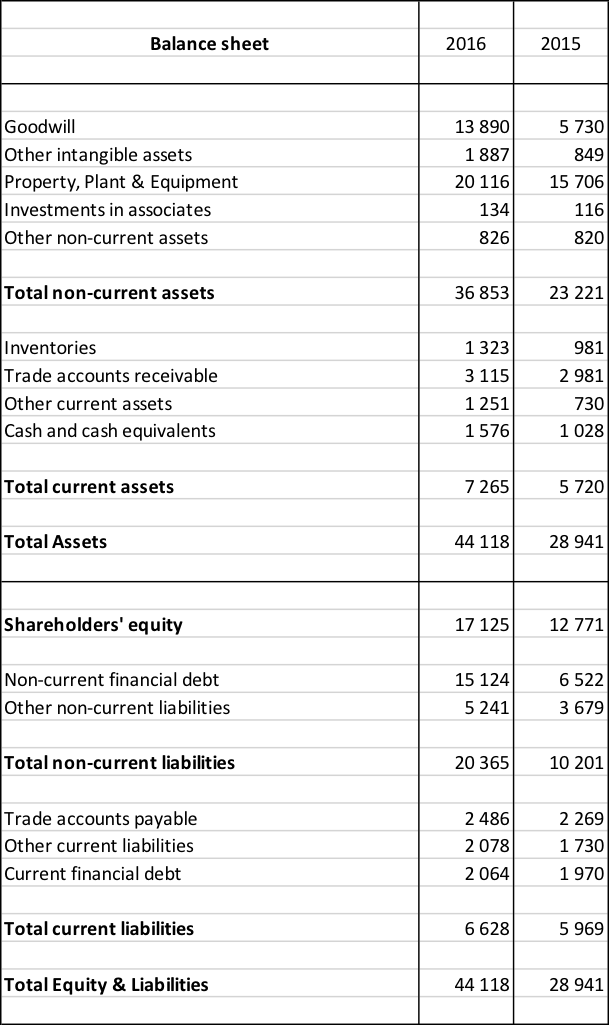

Here is the balance sheet for Air Liquide in 2015 and 2016. You have to build the financial balance sheet and interpret it.

Exercise Summary

0 of 8 Questions completed

Questions:

Information

You have already completed the exercise before. Hence you can not start it again.

Exercise is loading…

You must sign in or sign up to start the exercise.

You must first complete the following:

Results

Results

0 of 8 Questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 point(s), (0)

Earned Point(s): 0 of 0, (0)

0 Essay(s) Pending (Possible Point(s): 0)

Categories

- Not categorized 0%

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

-

Question 1 of 8

1. Question

CorrectIncorrectHint

WCR = inventories + trade accounts receivable + other current assets – trade accounts payable – other current liabilities

-

Question 2 of 8

2. Question

CorrectIncorrectHint

Don’t forget to deduct the other non-current liabilities in the calculation.

-

Question 3 of 8

3. Question

CorrectIncorrectHint

Cash must be deducted from the sum of current and non-current financial debt; don’t confuse non-current liabilities and non-current financial debt.

-

Question 4 of 8

4. Question

CorrectIncorrectHint

Don’t forget the other non-current liabilities in the long-term resources, as well as the non-current financial debt

-

Question 5 of 8

5. Question

CorrectIncorrectHint

Remember, you deduct the current financial debt from cash.

-

Question 6 of 8

6. Question

CorrectIncorrectHint

Goodwill is a non-current asset

-

Question 7 of 8

7. Question

CorrectIncorrectHint

Which financial resource was predominantly mobilized?

-

Question 8 of 8

8. Question

CorrectIncorrectHint

Shareholders’ equity represents the contribution of shareholders to the financing of the company, net of what was distributed to them